AI-Powered Access to Real World Assets

The What, The Why, and The How

Catalysts for AI Integration in RWAs

1/5

Regulatory Clarity

Enhanced global regulations have paved the way for compliant RWA tokenization, providing a secure environment for asset digitization.

2/5

Technological Advancements

The Ethereum Shanghai Upgrade and the rise of AI-driven automation have unlocked new avenues for asset management and deployment.

3/5

Robust Security Infrastructure

Major digital asset custodians (including our partner Ceffu) are sufficiently advanced in their offerings to support a blockchain usecase for yield.

4/5

Growing Public Awareness

Increased understanding of decentralized finance (DeFi) and tokenized assets has expanded the addressable market for RWAs.

5/5

Onchain Capital Mobilization

Over $100 billion in stablecoins from retail and institutional holders are seeking efficient deployment, highlighting the need for scalable RWA solutions.

RWALayer: Not Just Another Protocol

As users deposit TVL to the L2, it

automatically deploys into the

treasury. Alongside this, as users

engage in defi activities on the

protocol, they earn yield from

treasury exposure.

The protocol is built similar to a chain whereby all stablecoins bridged earn yield, alongside the yield users generate by engaging in native DeFi farming.

The protocol is built similar to a chain whereby all stablecoins bridged earn yield, alongside the yield users generate by engaging in native DeFi farming.

Staking That Scales With RWALayer’s Growth

RWALayer lets you stake RWALayer's Stablecoin to boost your rewards.

Stakers earn a share of the platform’s activity, meaning as RWALayer grows, so do your rewards.

Stake RWALayer's Stablecoin → lock in your tokens.

Earn Boosted Rewards → receive a higher % back on every trade you make.

Support Growth → stakers help strengthen the reward pool for all users.

Stakers earn a share of the platform’s activity, meaning as RWALayer grows, so do your rewards.

Stake RWALayer's Stablecoin → lock in your tokens.

Earn Boosted Rewards → receive a higher % back on every trade you make.

Support Growth → stakers help strengthen the reward pool for all users.

RWALayer's Stablecoin: Rewards That Work

Every trade on RWALayer earns you RWALayer's Stablecoin.

Each trade generates a small platform fee.

Instead of extracting those fees, RWALayer redistributes them back to users as RWALayer's Stablecoin rewards.

The more you trade, the more you’re rewarded, creating a flywheel of trading and rewards.

Instead of extracting those fees, RWALayer redistributes them back to users as RWALayer's Stablecoin rewards.

The more you trade, the more you’re rewarded, creating a flywheel of trading and rewards.

RWALayer’s Key Assets

1/5

RWALayer App

A comprehensive platform for managing RWA assets, providing tools for trading, storage, and yield generation.

2/5

Property by RWALayer

An onchain real estate trading platform offering global access to tokenized property investments.

Tether Gold

3/5

Commodities Platform

Trade and store digital representations of real commodities, such as gold, silver, and copper, within a secure blockchain environment.

4/5

Private Credit Marketplace

Access tokenized private credit opportunities, expanding investment options beyond traditional markets

5/5

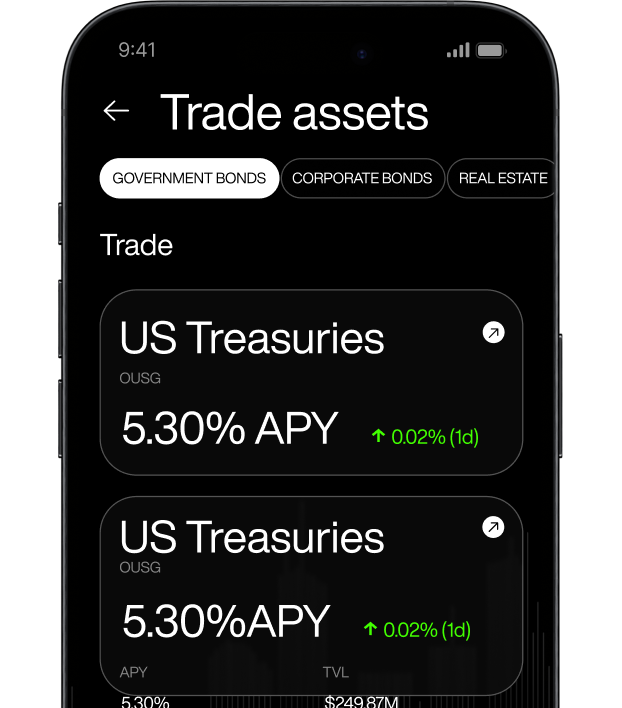

Government Bonds Access

Invest in tokenized government bonds through stablecoin intermediaries and regulated on-chain funds, providing exposure to sovereign debt instruments.

Ecosystem Components

Affiliate Rewards: Driving Growth Through Trading

Mass Adoption via RWA Access

70+

Countries → users trading across the globe

RWALayer rewards users directly for their activity. Every trade made in the app earns you airdrop points, giving you a real stake in the platform’s growth.

53k+

Participants → already earning rewards through the app

RWALayer flips the model: instead of fees going to middlemen, rewards go straight back to the community — the traders who power the ecosystem.

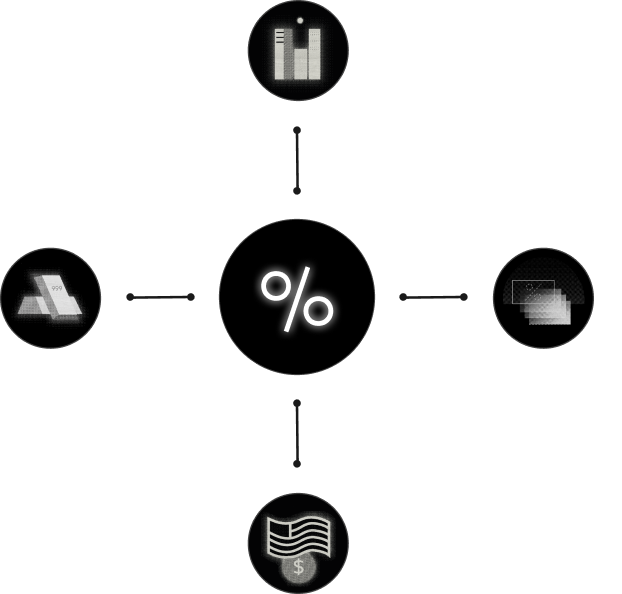

The Token Economy: RWALayer's Stablecoin

The native token, RWALayer's Stablecoin, serves as the cornerstone of the RWALayer ecosystem, facilitating transactions, governance, and access to premium features. Holding RWALayer's Stablecoin enables users to participate in the network's growth and decision-making processes.

RWALayer's Stablecoin

Native Stablecoin

RWALayer’s stablecoin that powers the RWALayer app.

Trade Rewards

Users earn reward tokens every time they trade in app.

Staking

Stake the native token to boost rewards and share in the platform’s growth.

Governance

Holders of the RWALayer Stablecoin will be able to participate in shaping future features, rewards distribtuion and community initiatives.

Ecosystem Utility

The stablecoin underpins RWALayer’s reward pool, ensuring asustainable cycle that grows as trading activity increases.